Did The System Collapse?

NOTE: Daily graph is updated once per day

Intra-Day Graph is usually updated several times during the day and it includes my first data point 12/8/19 when I purchased an American Gold Eagle at a premium of $81.87/5.06%.

CURRENT UPDATE: 5/23/24 @ 12:00 NOON EST.

Spot Price (Goldprice.org): $2,347.85

Physical Price (Ebay Lowest Cost Buy Now Price From Dealer Selling Multiple Coins in quantities of more than 10: Liberty Coin – $2,451.89. Pre-sales for future delivery are not counted.

Dollar Premium: $104.04

Percentage Premium (Physical/Spot): 4.43%

Premium for second lowest price dealer selling in quantities of more than 10 – APMEX: $108.55/4.62%.

Ebay Coin Dealer Comparison

The chart which appears below shows how the Ebay (physical) price of gold differs between the lowest vs. the second-lowest cost dealer. The 90 Period Moving Average (in red) is hard to interpret but I noticed that there are certain times when this differential spikes up. I don’t know if this is an important number but I decided to include it so that visitors to this site can keep track of it.

1/12/21 is a good example. The percentage differential spiked up above 1.8% early in the day and this was followed by the physical gold premium moving above 10% by evening. Interesting …

The gap you see in the chart is the result of a short period of time when there was only one Ebay dealer offering coins in quantities of at least 10.

As of 6/12/23 @ 7:30 AM EST the percentage differential is: 0.23%.

RECENT DEVELOPMENTS IN THE PHYSICAL GOLD MARKET

- I decided to update this page after almost a year because I couldn’t believe how low the physical premium declined as the price skyrocketed recently. Current premium is: $104.04/4.43%

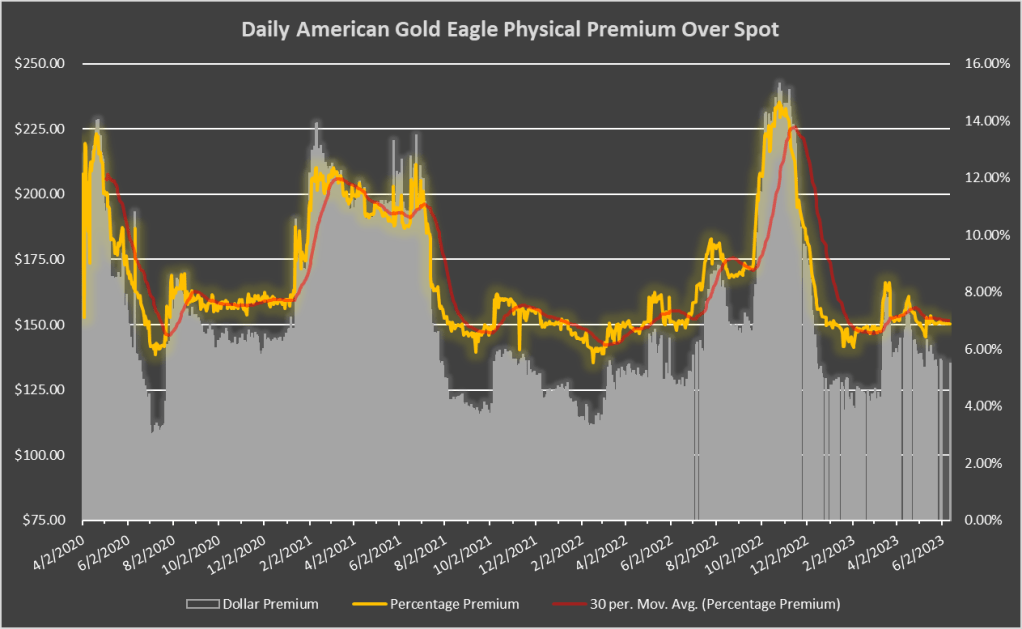

- UPDATE 10/19/22 @ 9:00 AM EST: The physical premium on American Gold Eagles reached 13.93% yesterday. This is higher than the premium from back during the Corona panic of 2020. The high point then was “only” 13.77% on 4/21/20. Its hard to believe that the premium was below 9% just under a month ago. Something wicked this way comes?

- UPDATE 5/4/22 @ 2:00 PM EST: The Physical Gold Premium jumped to 7.82%. It might not sound like much of premium when it comes to physical gold but I think it is noteworthy for five reasons: 1) The physical premium has not been consistently in the 7% range since December of 2021, 2) For most of 2022 the physical premium meandered between 6-7%, 3) This high 7% physical premium which began on 5/3/22 continues into 5/4/22, 4) The spread between the lowest and second lowest cost dealer on Ebay has exploded to almost 2%, 5)The physical gold/silver ratio has remained steady in the mid 50’s area while the spot gold/silver ratio has jumped above 80.

- UPDATE 9/23/21 @ 8:40 AM EST: The Physical Premium Percentage has come way back down as of this morning because Liberty Coin is back selling in large quantities. It now stands at 6.73%. However, the Percentage Differential Between the First & Second Low Cost Ebay Dealers is back above 2%.

- UPDATE 9/22/21 @ 8:10 PM EST: The Physical Premium Percentage has jumped to 9.24%. Not sure if this is just a temporary thing or not but it may have something to do with the Federal Reserve Meeting today.

- UPDATE 9/16/21 @ 10:20 AM EST: The percentage differential between the two lowest cost Ebay coin dealers selling in quantities of more than 10 has jumped to almost 3%. It hasn’t been this high since early February 2021. This could signal some stress in the Physical Gold Market (assuming that the differential remains elevated).

- UPDATE 9/3/21 @ 11:20 AM EST: The Physical Gold Premium has remained in the mid to high 6% range since August 12, 2021.

- UPDATE 8/5/21 @ 3:30 PM EST: The Physical Gold Premium has now gone under 7.00% (6.89%). This hasn’t happened since July 23, 2020.

- UPDATE 7/21/21 @ 9:50 PM EST: The Physical Gold Premium has now dipped under 8.00% – it’s at 7.88%.

- UPDATE: 7/21/21 @ 1:25 PM EST: The Physical Gold Dollar Premium has remained under $150.00 since 7/18/21.

- UPDATE: 7/15/21 @ 8:30 AM EST: The Physical Gold Dollar Premium has declined under $150.00. This is the lowest since January 11, 2021.

- UPDATE: 7/14/21 @ 9:25 AM EST: The Physical Gold Premium has now declined even further. It stands at 8.51%. This is the lowest since January of 2021.

- UPDATE: 7/12/21 @ 8:40 PM EST: The Physical Gold Premium has declined below 10% for the first time since 1/29/21. It now stands at 9.86%.

- UPDATE: 6/17/21 @ 12:00 NOON EST: This morning the physical gold premium jumped above 12% (while the spot price plunged below $1,800.00) as the recent low cost dealer, APMEX, no longer had large quantities of coins for sale. Now that APMEX has come back in with more than 10 coins available, the percentage premium has declined to 10.92%

- UPDATED 6/1/21 @ 9:40 AM EST: APMEX only has 7 coins for sale at its lowest price (at least for now). This means Liberty Coin is the lowest cost dealer in quantity and so the premium has jumped well above 11%. Not sure how long this will last because APMEX usually comes back in with more coins later in the morning/early afternoon. True to form, APMEX came in again with coins in quantity by 7:00 PM EST so the physical premium has declined under 11.00%. However, the dollar premium is still over $200.00

- UPDATED 5/26/21 @ 11:20 AM EST: APMEX only has 10 coins for sale at its lowest price so is no longer considered the lowest cost dealer in quantity. Now it is Liberty Coin: $2,126.04. (APMEX: $2,100.29). NOTE: By 1:50 PM EST APMEX came back in with more than 10 available so the premium is back down.

- UPDATE 5/25/21 @ 10:30 AM EST: Well, that didn’t last long. APMEX came in quickly with a lower price so now the premium has declined to under $200.00.

- UPDATE 5/25/21 @ 7:30 AM EST: The physical gold dollar premium is now back above $200.00. This is the first time since the middle of May where it briefly went over that mark on 5/12 & 5/14. Before that, you have to go to April to see a $200.00 premium. Once again, that was only a brief situation on several days because it could not hold above that mark for long. The last sustained time with a premium over $200.00 was from 2/3 through 3/17.

- UPDATE 5/13/21 @ 12:45 PM EST: APMEX has only 7 coins for sale so is no longer the lowest cost dealer in quantity. Liberty Coin is lowest @ $2,042.15. This represents a premium of $215.97/11.83%. But by the evening of 5/13 APMEX was back in as the lowest cost dealer in quantity.

- UPDATE 5/12/21 @ 2:00 PM EST: The physical gold premium temporarily spiked above $200.00 ($214.79) but by later in the evening it had settled back below. At 8:00 PM EST it now stands at $195.68.

- UPDATE 4/12/21 @ 8:00 PM EST: That private individual offering the lowest price in a long time has now sold out. It was almost too good to be true, unfortunately. Now, we are back to business as usual. Liberty Coin is the lowest cost dealer once again.

- UPDATE 4/12/21 @ 12:15 PM EST: A private individual has come in the market offering more than 10 coins at a very steep discount to standard dealers: $1,875.67. This is a $143.47/8.29% premium.

- UPDATE 3/28/21 @ 7:20 PM EST: Things have settled down as the second low cost dealer, Liberty Coin, is back offering in quantity.

- UPDATE 3/25/21 @ 7:00 PM EST: The second lowest cost dealer selling in quantity is no longer Liberty Coin. Now APMEX has attained this slot which has increased the premium immensely. The premium for APMEX is : $245.21/14.19%.

- UPDATE 3/19/21 @ 1:50 PM EST: The physical dollar premium dipped just below $200 starting on 3/17/21 and remains there as of this update.

- UPDATE 2/18/21 @ 8:30 PM EST: The physical dollar premium has remained above $200.00 since 2/3/21. In addition, the physical percentage premium has been in the high 11% to low 12% range since that same date. All the while, the spot price has declined from about $1,835 to $1,760. Interesting …

- Update 2/10/21 @ 2:00 PM EST: From 2/3/21 @ 12:10 PM EST to 2/10/21 @ 2:00 PM EST there was only one dealer selling in quantities of more than 10 coins: APMEX. Now Liberty Coin is offering Gold Eagles in quantity. It appears as if the shortage may be letting up a bit.

- UPDATE 2/8/21 @ 7:10 PM EST: There is still an apparent shortage in the physical gold market. Not only is there still only one dealer selling Gold Eagles in quantities over 10 coins (APMEX), but the premium has spiked above 12% after hovering in the high 11% range since late 2/4/21.

- UPDATE 2/4/21 @ 9:35 AM EST: The shortage in the physical gold market that manifested yesterday continues. Also, I should note that the physical premium is now above 12%

- UPDATE 2/3/21 @ 12:10 PM EST: Something may be happening under the surface of the physical gold market. For the first time since I have been keeping records there is only one dealer selling in quantities of more than 10 coins.

- UPDATE 1/29/21 @ 10:15 PM EST: Physical gold premium is back above 10%

- Update 1/20/21 @ 8:30 AM EST: Physical gold premium dipped below 9%; however, in the evening it moved back above 9%

- UPDATE 1/18/21 @ 10:30 AM EST: Physical gold premium moved back above 10% in the morning and then by the afternoon it was back in the mid 9% range.

- UPDATE 1/13/21 @ 12:00 NOON EST: Physical gold premium moved below 10%.

- UPDATE 1/12/21: Something may be up. The physical gold premium spiked above 9% on the morning of 1/12/21 and then by evening it had broken through 10%.

- Since 8/20 the physical gold premium has remained in the 7-8% range. Clearly, physical premiums have remained subdued since the Corona virus scare.

- The premium first went below 7% on 6/24/20 and remained there until it went below 6% on 7/1/20. It remained in the low 6% area until gold and silver started rising toward the end of July. The premium is now above 8%.

- The premium went below 8% for the first time on 6/8/20. It danced above and below 8% for the next week or so until on 6/17/20 it settled firmly below the 8% threshold.

- The premium went back above 9% on 5/31/20 but didn’t stay there long as the very next day it dipped below.

- On the afternoon of 5/26/20 Pinehurst Coin offered a “daily deal” which brought the premium back under 10%. The “deal” continued into 5/27 when Liberty Coin undercut Pinehurst bringing the premium even lower It has now dipped below 9%.

- On the morning of 5/25/20 the premium went back above 10%.

- On 5/10/20 the premium percentage went below 10% and, despite a brief move back above (on the mornings of 5/12/20 & 5/13/20), it is now back below 10%.

- Since 5/6/20 the premium percentage has been

- below 11%.

- On 4/29/20 the premium percentage fell below 12%.

- On 4/29/20 the premium price fell below $200.00 per ounce and has remained there since.

- The physical premium hit a high on 4/21/20 – $232.27/13.77%

- Notice in early April that there were several large dips in premium. These were daily dealer specials which have not appeared since.